Most of us will be aware of all the support being made available to businesses and individuals amid the current COVID-19 crisis; however not much has been said about how you can actually positively impact the current situation you or your business is experiencing.

In this blog we will explore both defensive and offensive strategies designed to help businesses survive and grow.

Fundamentally, business survival comes down to one of two approaches, or in all likelihood a combination of both in the current climate.

- An offensive approach – focussed on growth. This approach is about planning for longer term survival as for many businesses the impacts will not just be in the here and now.

- A defensive approach - focussed primarily on how to avoid losses and minimise risks. This approach is very much about short-term survival.

Successful businesses from the last recession generally emerged stronger and more resilient and employed a wide range of strategies that broadly fit into the two categories above, and whilst there is no guarantee these will work as the COVID-19 crisis is clearly different to the recession of 2008, the guiding principles are clearly worth exploring.

The defensive approach

The immediacy of the current crisis means most businesses will rightly focus on the defensive measures first and as such we will explore these first before looking at the offensive approach in our next blog. These strategies are designed to achieve short-term survival and are not long term solutions to your ongoing success.

- Government interventions in the UK have provided a variety of support measures to businesses that include CBILs, Employee Job Retention Scheme, HMRC payment support, business grants, rate relief, loan, mortgage and VAT holidays. We will not explain these here as the guidance is available on Gov.UK; however, many of these provide significant financial support to help short-term survival.

- Furloughing staff provides you an opportunity to reduce costs now but does require careful consideration. Ask yourself what roles are essential for the business to continue to operate? How long can the business survive without certain functions being fulfilled? Do you want to top up salaries or reduce to the 80%? The scheme certainly provides an opportunity to reduce costs very quickly and with the Government confirming employers will be able to apply from the 20th April it is likely to yield payments sooner than many of the other options mentioned above. Don’t forget to check the rules and put stringent measures in place to ensure you comply with them.

- Financial review of all your suppliers. What can you do without? What payments are essential or non-essential? Does changing payment dates of standing orders make a difference? There are many questions to ask yourself here. Be ruthless, cancel what you can but more than anything communicate clearly with your supply chain first. You will be surprised what options you may have from payment holidays to reducing payments in the short-term term. Support the small, local suppliers and play tough with the big nationals. Paying small, local suppliers first may mean the difference to their survival or not.

- Cancel all non-essential direct debits / standing orders. Cancelling direct debits and standing orders does not mean that you won’t pay; it just puts you in control of when and how much you pay. By cancelling, you can manage your cash flow and importantly when and how much you can afford.

- Renegotiate existing finances or discuss payment plans with suppliers. Can you combine several loans into one and increase the term to reduce monthly outgoings, can you discuss payment plans with suppliers where you have large outstanding bills? Nothing should be off the table here. Remember, they will want you to survive because if you do not, they will get little or nothing.

- Review all other costs. Do you need those expensive premises? How long do you have left on those leases? Do you have any contracts with early release clauses you can activate

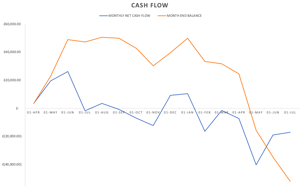

- Financial planning & profiling. Once you have completed this, you must financially plan the next 12 months as a minimum. Plan several scenarios, plan all costs, assume nothing (or assume worst case), establish your break-even point each month and at what point the cash runs out in the months ahead.

Such a financial plan is critical. Planning several scenarios allows you to see what your options are moving forward; it allows you to plan various ‘what if’ options; it allows you to plan when you may need to make other cost savings; it allows you to know where your income gaps are; and, perhaps most importantly, it allows you to set timescales for the adoption of the offensive strategy you will need in order to move the business forward in the medium to long term.

Such a financial plan is critical. Planning several scenarios allows you to see what your options are moving forward; it allows you to plan various ‘what if’ options; it allows you to plan when you may need to make other cost savings; it allows you to know where your income gaps are; and, perhaps most importantly, it allows you to set timescales for the adoption of the offensive strategy you will need in order to move the business forward in the medium to long term.

Constant monitoring & review

This, along with the options selected above may well need reviewing daily, weekly or monthly depending upon your business and the challenges it is facing.

One thing for certain about COVID-19 is that everything is uncertain and the speed of change rapid; so don’t take your eye off the ball.

This defensive strategy should hopefully allow most businesses to create a short-term survival plan and by financially profiling the outcomes you should be able to see where the challenges are moving forward. It won’t solve everything, but it is the starting point.

Next steps …

Once you have a blueprint for survival and a clear financial plan for the next 12 months you are ready to explore the offensive strategy. Grab some rest, recharge the batteries and come back in a few days with a positive mental attitude; for this strategy will be a time of change, of new beginnings and of new opportunities.

Make sure you don’t miss out on the offensive strategy by signing up to our blog.

#inspiration #entrepreneur #leadershipdevelopment #marketing #startups #leadership